Earn passive income with just a few clicks

We provide a reliable validator infrastructure, auto-restake option and constantly growing list of validated networks.

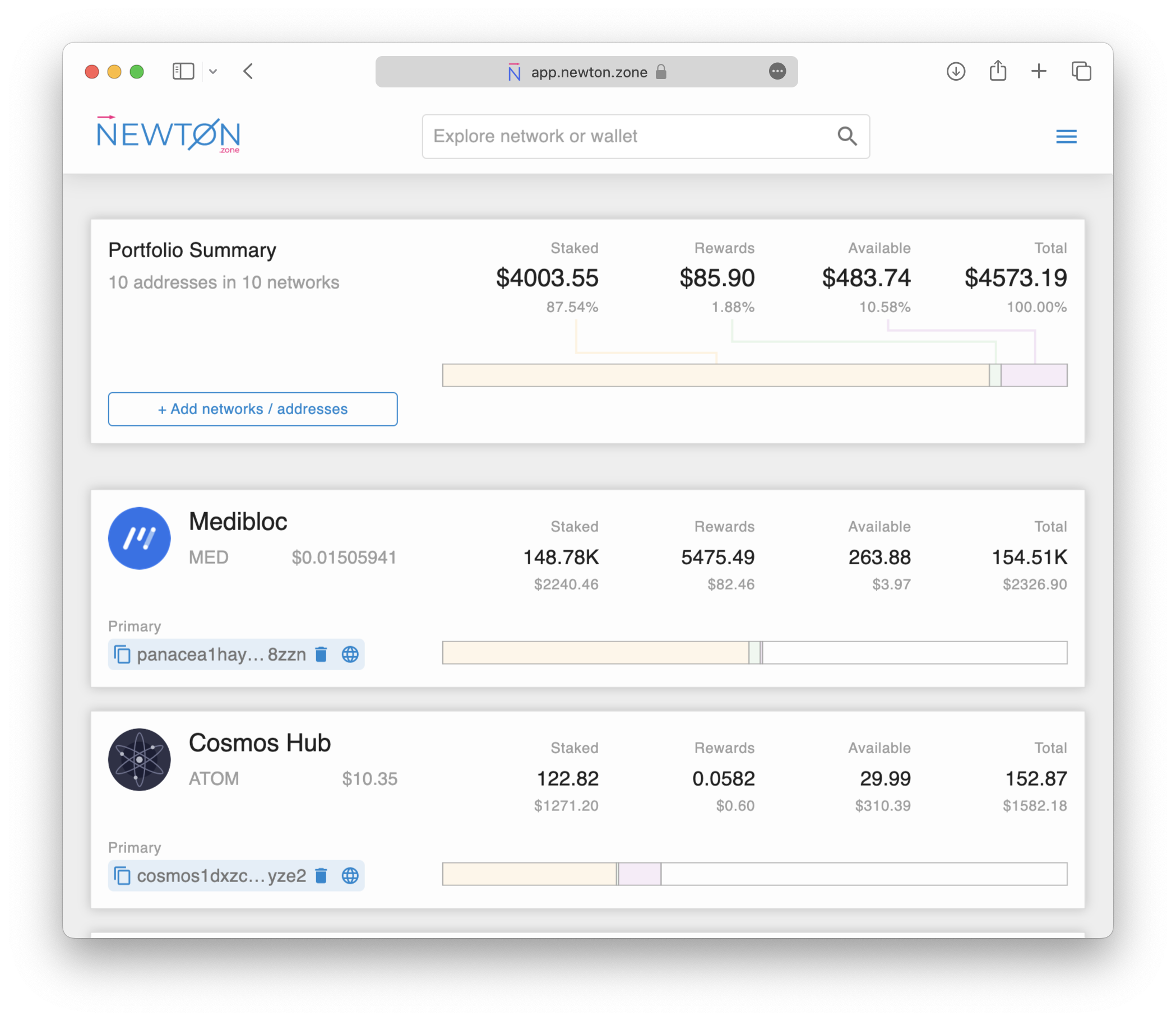

Select networkWith our app, you can easily manage your entire investment portfolio, tracking already existing positions as well as creating new ones.

Take a lookNew to the ecosystem? We've collected a range of guides to help you secure your funds and make more informed decisions.

Dive in

We ensure maximum uptime: our highly reliable infrastructure includes 24/7 monitoring and auto-failover for each node

All our nodes support restaking, letting you maximize your earnings

A blockchain hub that provides a trust-less marketplace for the music industry.

Blockchain protocol powered by Forbole designed for user-centric social networks.

Digital healthcare platform with a patient-centric healthcare data solution.

Lum Network is the blockchain that empowers anyone to use Web3 products.

AssetMantle is a community focused one-for-all NFT platform.

More networks are coming

Here you will find some helpful information you may need before start

Still have doubts? Ask a question.

Blockchain is a distributed, decentralized ledger technology that allows for secure, transparent, and tamper-proof transactions. Cryptocurrency, on the other hand, is a type of digital currency that uses encryption techniques to secure and verify transactions and to control the creation of new units.

One of the main benefits of blockchain and cryptocurrency is that it removes the need for intermediaries like banks, payment processors, and other third-party institutions that typically mediate financial transactions. This means that transactions can be conducted directly between individuals or entities, without the need for a middleman.

Another advantage of blockchain and cryptocurrency is that it provides increased security and privacy for transactions. Because transactions are recorded on a decentralized ledger that is distributed across a network of computers, it is extremely difficult for any one party to manipulate or alter the transaction history.

In addition to these benefits, blockchain and cryptocurrency also offer fast and efficient transaction processing, low fees, and the potential for global reach and accessibility. With these advantages, blockchain and cryptocurrency are poised to revolutionize the way we conduct financial transactions and exchange value in the digital age.

Proof of Stake (PoS) is a consensus mechanism used by some blockchain networks as an alternative to Proof of Work (PoW). In PoW, network participants compete to solve complex mathematical problems to add new blocks to the chain and validate transactions. This process is computationally intensive and requires a lot of energy, leading to environmental concerns.

In contrast, PoS allows participants to validate transactions and earn rewards based on the amount of cryptocurrency they hold and "stake" in the network. This means that the more tokens you hold and "lock up" for a certain period, the higher your chances of being chosen as a validator to validate transactions on the network. This process is called staking.

PoS has several advantages over PoW, including reduced energy consumption and a more decentralized network, as it allows more users to participate in the validation process without requiring expensive hardware.

As a validator, we play a significant role in the network's decentralization and security by running a node that validates transactions and participates in consensus. At our platform, we provide users with the ability to stake their tokens on different PoS networks and earn rewards while contributing to the network's security and decentralization.

Cosmos is an open-source ecosystem designed to facilitate the development and interoperability of decentralized applications (dApps) and blockchain networks. The goal of Cosmos is to create a "Internet of Blockchains", where different blockchain networks can communicate and exchange data with each other seamlessly.

Cosmos is based on a unique architecture called the Tendermint Core, which is a Byzantine Fault Tolerant (BFT) consensus engine. This means that it allows for fast, secure, and efficient communication and transaction processing between different blockchain networks.

As a validator on the Cosmos ecosystem, our role is to secure the network by participating in the consensus process and ensuring the integrity of transactions. By doing so, we help maintain the decentralization and security of the entire ecosystem.

Making transactions on the Cosmos ecosystem is easy and secure. The most common way to do it is through a wallet that supports the Cosmos ecosystem, such as the Keplr wallet. Keplr is a browser extension that allows you to manage your Cosmos-based assets and sign transactions securely.

To get started with Keplr, simply download the extension for your browser and create a new wallet. Once your wallet is set up, you can easily manage your assets and make transactions within the Cosmos ecosystem.

You can connect your Keplr wallet to our application. Once connected, you can see your balances and perform all necessary operations directly in our app.

To buy tokens of a particular network, there are two main options: centralized exchanges (CEXes) and decentralized exchanges (DEXes). Some of the most well-known CEXes include Binance, Coinbase, and Kraken. However, if the token you're looking for is not available on these platforms, you may need to explore DEXes.

One popular DEX in the Cosmos ecosystem is Osmosis. Osmosis allows you to trade almost all Cosmos-based tokens and even some that may not be available on CEXes. Additionally, you can also buy tokens on Osmosis using fiat.

More information on how to connect and use Osmosis:

Introduction To Osmosis.

To get started with Osmosis, you'll need to connect your Keplr wallet to the platform. From there, you can view your balances and perform transactions directly within the app.

Restaking refers to the process of automatically reinvesting your earned rewards back into the same validator, thus increasing the size of your staked tokens and resulting in more rewards over time according to the rule of Compound Interest.

At its most basic level, compounding refers to earning or paying interest on previous interest. To better understand the difference between Annual Percentage Rate (APR) and Annual Percentage Yield (APY), let's take an example. Let's say you have staked 1000 tokens in a validator with an APR of 20%. Assuming daily compounding, the APY would be calculated as follows:

APY = (1 + 0.2/365)365 - 1 = 22.1%

So, after one year, the total number of tokens you have would be 1221 (for comparison, you will have only 1200 without compounding).

More information about APR & APY:

APR vs. APY: What’s the Difference? (Investopedia.com)

At our nodes, we support restaking, which allows you to maximize your returns and increase your long-term profits. Additionally, we cover all commissions associated with restaking, making it even more convenient and cost-effective for you.

Choosing an optimal investment strategy is a key factor in maximizing your returns while minimizing risks. In general, the potential profits are proportional to the risks involved. Therefore, it is important to consider the risks before investing.

The APR (Annual Percentage Rate) offered by the network is one of the key factors to consider. The APR often depends on the project's stability and development potential. A more solid project may offer a lower APR but also have lower risk of significant losses on a price drop. Therefore, it's important to research the project and understand its potential before investing.

It's also important to note that when investing in staking, you won't have the possibility to cash out all of your position immediately due to the unbonding period required for each network. However, you can withdraw your rewards immediately. Enabling restaking may maximize earnings, but it can also lock your rewards for the unbonding period. For some situations, it may be a more conservative strategy to fix rewards time-to-time.

Additionally, diversification is an important factor in the risk control. By spreading your funds across several projects with different parameters and levels of risk, you can minimize the impact of any individual project's potential failure on your overall portfolio. Our platform offers a variety of networks with different basic parameters, allowing you to combine approaches and find the optimal strategy for your portfolio.

Here are some steps you can take to secure your funds:

Delegating your funds to validators is always safe because validators have no control over your funds, and they remain under your ownership at all times.